WSQ LCCI Level 2 Essentials of Cost Accounting Course

Preparation for IAB LCCI Level 2 in Cost Accounting exam

Enhance your financial expertise with the WSQ LCCI Level 2 Essentials of Cost Accounting Course in Singapore. Learn cost classification, budgeting, and control techniques to optimize business efficiency. Ideal for professionals seeking practical skills in cost management and financial planning.

WSQ

Singapore Workforce Skills Qualifications

SkillsFuture Eligible

PSEA

Post Secondary Education Account

Schedule

- Days: 6 Days

- Time Duration: 48 Hours

- Timing: 9:30 AM – 5:30 PM

- Venue: 10 Anson Road, International Plaza, Singapore 079903

SSG Course Details

-

TGS-2025052347

- Mode of Training : Physical Training

- Course Validity : 13-01-2025 to 29-12-2026

Key Features

Hands-On Exercises

Hands-On Exercises Attention to each participants

Attention to each participants 10 Year Experienced Trainer

10 Year Experienced Trainer SkillsFuture Approved Course

SkillsFuture Approved Course

Step-By-Step Course

Step-By-Step Course 100% Satisfactory Record

100% Satisfactory Record Trained more than 10000 Participants

Trained more than 10000 Participants

Entry Requirements

Above 16 years old

High School Level English

Basic internet & computer operation skills

Who Should Attend WSQ LCCI Level 2 Essentials of Cost Accounting Course

The WSQ LCCI Level 2 Essentials of Cost Accounting Course is ideal for aspiring accountants, business owners, finance professionals, and managers responsible for cost management. It’s perfect for anyone seeking to improve their cost control, budgeting, and financial decision-making skills.

Analyst

Business professionals

Entrepreneur

Training Professionals

Student

What Will You Learn WSQ LCCI Level 2 Fundamentals of Bookkeeping and Accounting Course

Unlock essential cost accounting skills with this WSQ LCCI Level 2 certified course. Learn how to effectively track, allocate, and control costs to improve financial decisions and business efficiency. Gain practical knowledge of budgeting, cost analysis, and financial planning strategies.

Key Learning Points:

- Key principles of cost accounting and cost behavior.

- Techniques for cost allocation and budgeting.

- Cost control strategies for efficient resource management.

- Understanding variance analysis for financial decisions.

- Implementing cost accounting for business success and growth.

Target Audience:

- Aspiring Accountants – Individuals looking to specialize in cost accounting for career advancement.

- Business Owners – Entrepreneurs aiming to optimize cost management for profitability.

- Finance and Accounting Professionals – Those seeking to enhance their cost analysis and budgeting capabilities.

- Managers and Supervisors – Professionals involved in budgeting and resource allocation in their organizations.

- Students – Learners pursuing accounting, finance, or business studies to gain practical cost accounting knowledge.

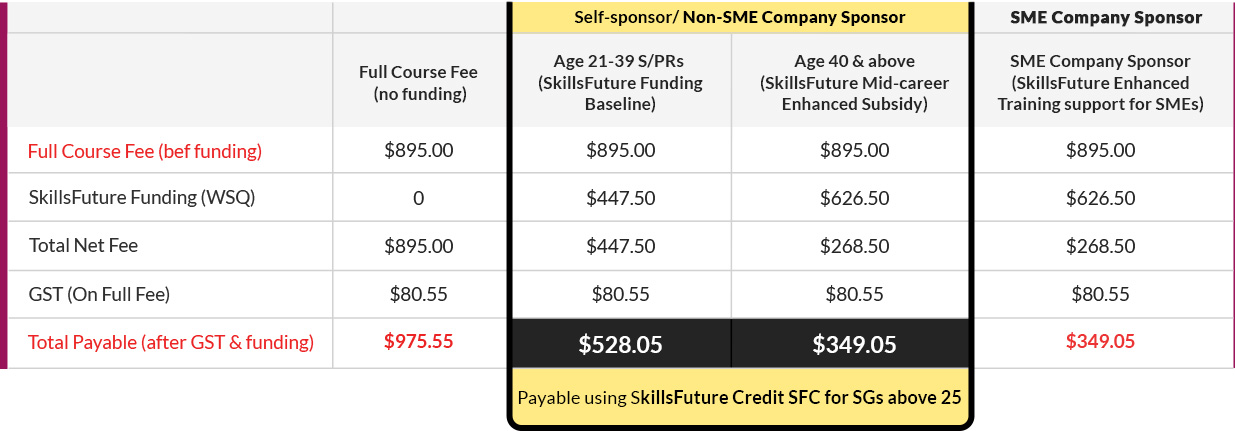

Training fee

*Course fee before WSQ funding: $895.00/pax + 9% GST.

Training material:

Only soft copy included, printed copy is payable additionally, please check with our sales

Funding: (GST included)

*The funding amount mentioned is indicative and will be confirmed upon registration.

+65 8421 2824

+65 8421 2824

Chat With Us

Chat With Us