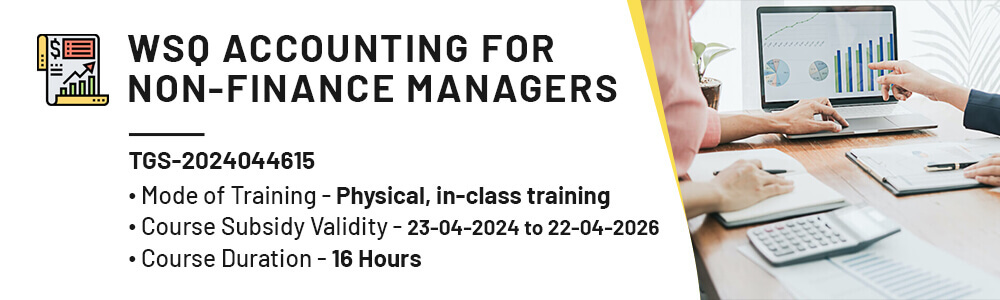

WSQ Accounting For Non-finance Managers Course in Singapore

Gain essential accounting knowledge with the WSQ Accounting for Non-Finance Managers Course in Singapore. Learn financial statements, budgeting, and cost control to make informed business decisions. Ideal for managers seeking financial literacy without a finance background. Enhance your strategic decision-making today!

WSQ

Singapore Workforce Skills Qualifications

SkillsFuture Eligible

PSEA

Post Secondary Education Account

Schedule

- Days: 2 Days

- Time Duration: 16 Hours

- Timing: 9:30 AM – 5:30 PM

- Venue: 10 Anson Road, International Plaza, Singapore 079903

SSG Course Details

-

TGS-2024044615

- Mode of Training : Physical Training

- Course Validity : 23 April 2024 to 22 April 2026

Key Features

Hands-On Exercises

Hands-On Exercises Attention to each participants

Attention to each participants 10 Year Experienced Trainer

10 Year Experienced Trainer SkillsFuture Approved Course

SkillsFuture Approved Course

Step-By-Step Course

Step-By-Step Course 100% Satisfactory Record

100% Satisfactory Record Trained more than 10000 Participants

Trained more than 10000 Participants

Entry Requirements

Above 16 years old

High School Level English

Basic internet & computer operation skills

Who Should Attend This WSQ Accounting For Non-finance Managers Course

The WSQ Accounting for Non-Finance Managers course in Singapore is tailored for individuals who are new to Microsoft Excel and seek to establish a solid foundation in using this powerful spreadsheet software.

Analyst

Business professionals

Entrepreneur

Training Professionals

Student

What Will You Learn WSQ Accounting For Non-finance Managers Course

By the end of this course, participants will gain practical skills in transactional accounting to effectively record financial events. The key learning outcomes are as follows:

- Mastering Double-Entry Accounting:

Participants will be able to accurately record double-entry transactions, including debits and credits, for sales, purchases, receivables, payables, and cash transactions.

- Handling Inventories, Accruals, and Prepayments:

Participants will learn to record inventories, accruals, and prepayments accurately in relation to sales, purchases, receivables, payables, and cash transactions.

- Preparing Basic Cash Flow Statements:

Participants will acquire the skills to prepare basic cash flow statements, documenting all incoming and outgoing cash transactions, for internal reporting purposes.

- Interpreting Singapore Financial Reporting Guidelines:

Participants will be able to understand and apply the guidelines set forth in the Singapore financial reporting regulatory framework.

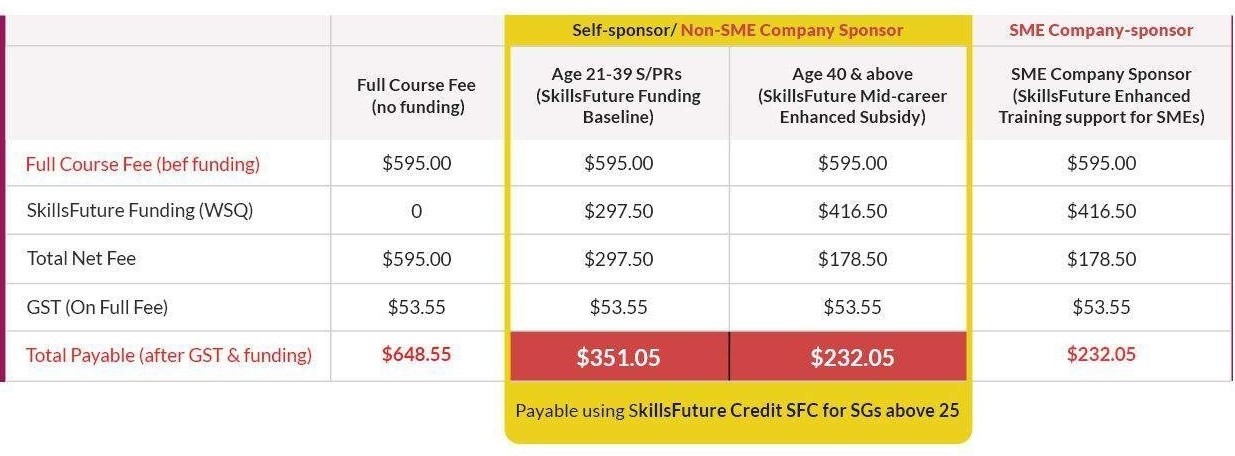

Training fee

* Total Course Fee Per Trainee bet GST – $595 + 9% GST.

Training material:

Only soft copy included, printed copy is payable additionally, please check with our sales

Funding: (GST included)

*The funding amount mentioned is indicative and will be confirmed upon registration.

Discount policy:

Assessment Plan:

WSQ Accounting For Non-finance Managers Course in Singapore Outline

Lesson 1

- Evaluate the application of current accounting standards and equations to ensure compliance with changes in financial reporting processes.

Lesson 2

- Compile financial statements and ensuring accuracy and adherence to ACRA regulatory requirements.

Lesson 3

- Evaluate significant accounting issues and limitation in financial statements.

+65 8421 2824

+65 8421 2824

Chat With Us

Chat With Us